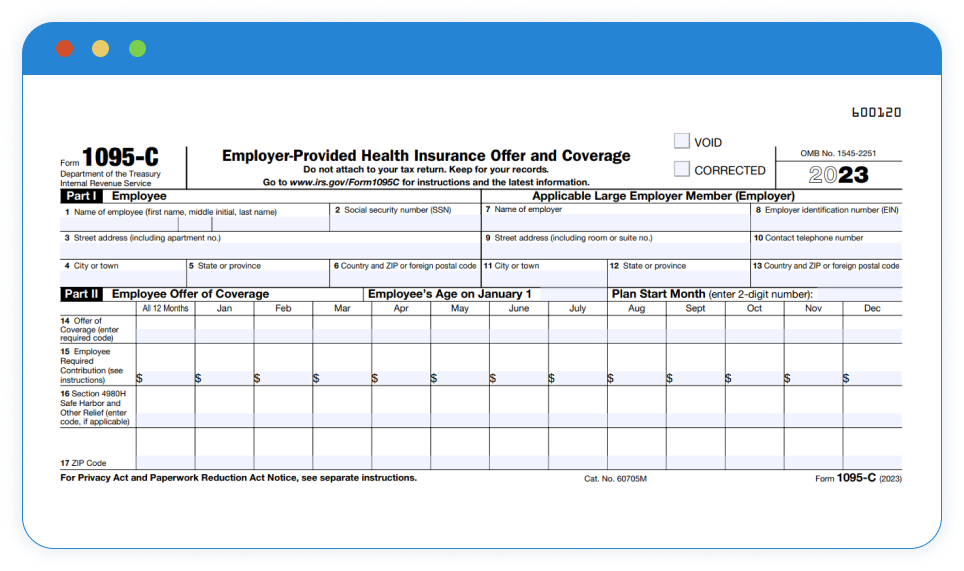

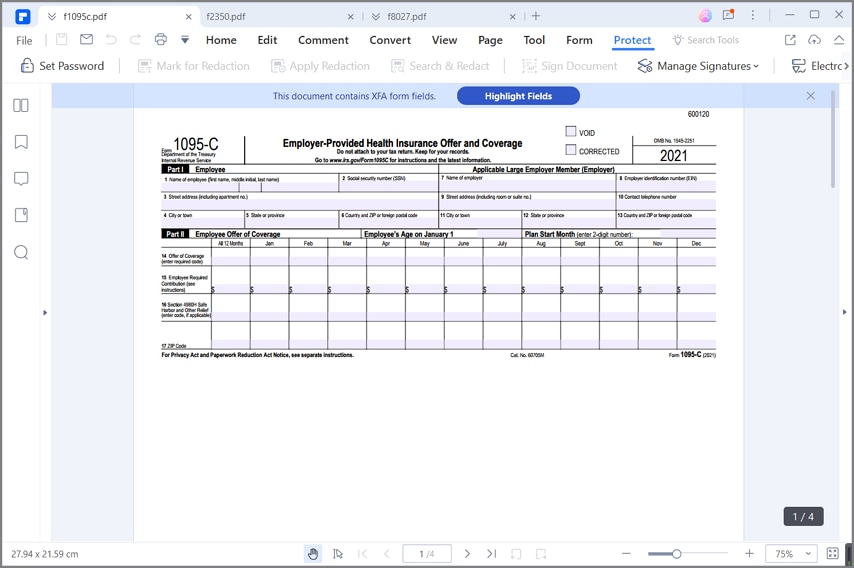

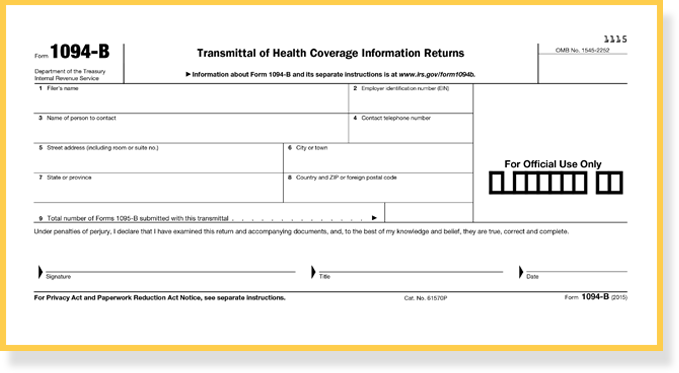

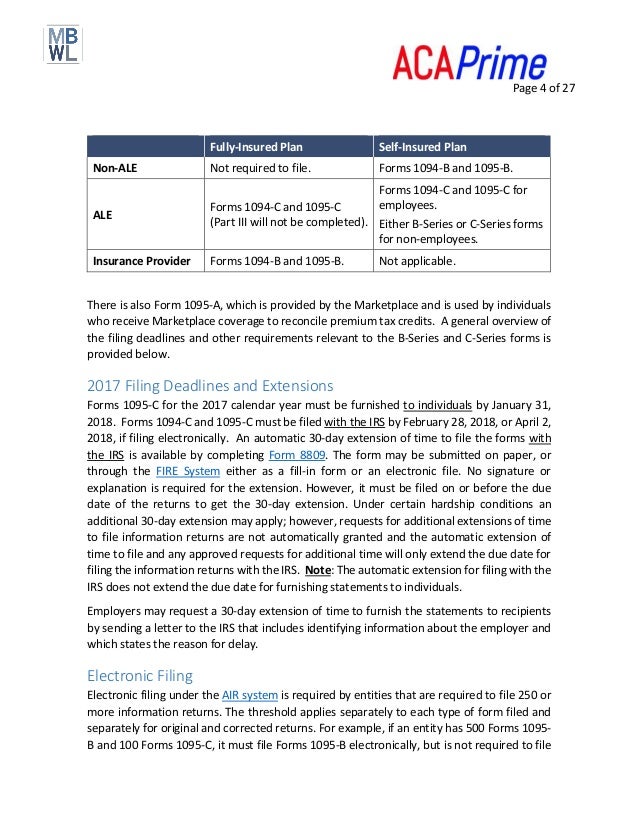

· For example, if an employer intends to file a separate Form 1094C for each of its two divisions to transmit Forms 1095C for each division's fulltime employees, one of the Forms 1094C filed must be designated as the Authoritative Transmittal and report aggregate employerlevel data for both divisions, as required in Parts II, III, and IV of Form 1094C · It comes from the Marketplace and shows both you and the IRS what you paid outofpocket for your insurance premiums If you have health insurance from a private insurer outside of the Marketplace or that you receive from an employer, your coverage will be reported to the IRS on Form 1095B (for coverage from other insurers) or Form 1095C (for employersponsored · Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C is a tax form reporting information about an employee's health coverage offered by an Applicable Large Employer more

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

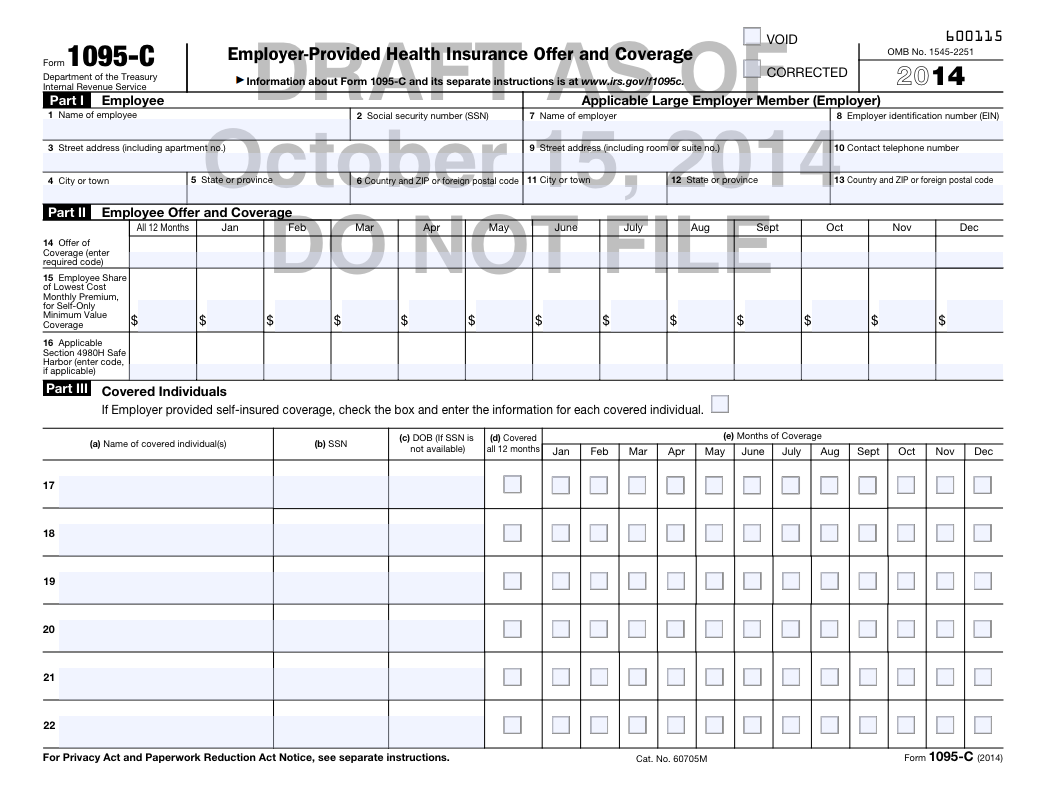

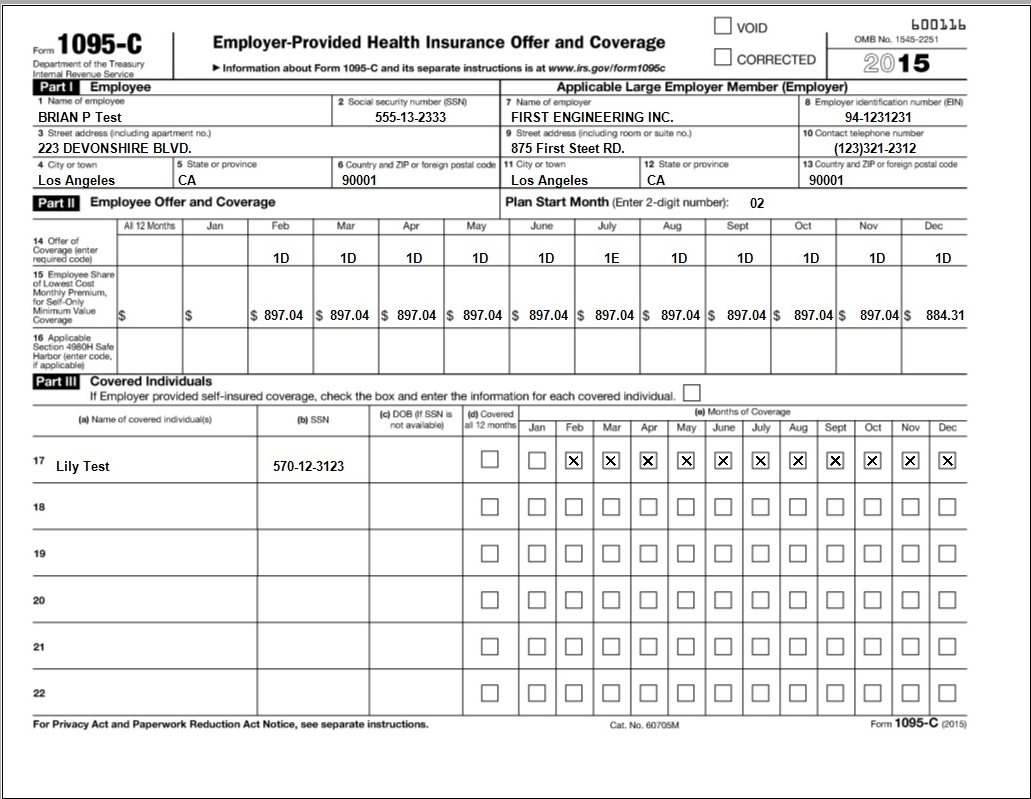

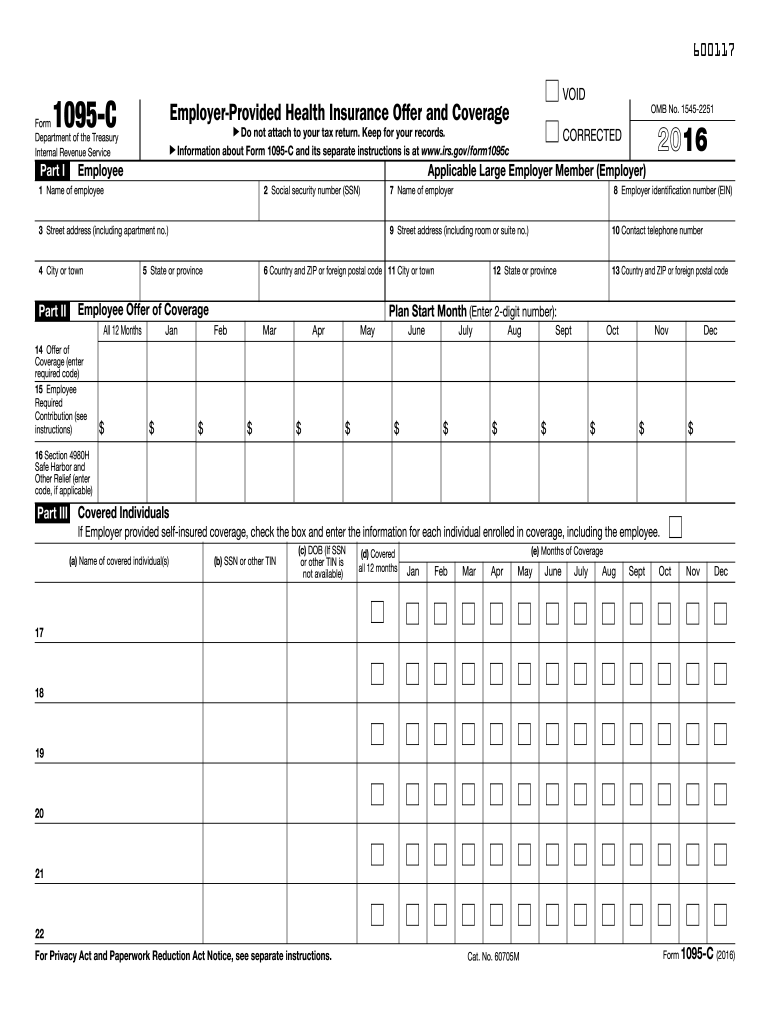

Example 1095-c filled out

Example 1095-c filled out-It's tax season your favorite time of year for filling out a million forms, staring at your computer for hours, and maybe pulling out your hair just a bit But, reporting doesn't have to be stressful To file your Form 1094C and Form 1095C, just take it one step at a timeYou may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form(s) as a part of your personal tax filing Your employer generally is required to distribute your Form 1095C by January 31st, covering information for the previous calendar year

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

1095C submissions and corrected IRS Form 1095C submissions – they need to be transmitted separately Our application allows you to select between Original and Corrected •It is possible to submit a corrected IRS Form 1094C without any corresponding IRS Form 1095C–for example •Total employee count was wrong for a month0121 · Form 1095C Line by Line Instructions Updated on January , 21 1030am by, TaxBandits IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updatedForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

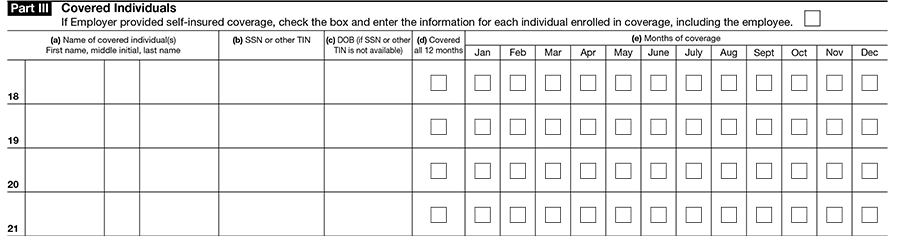

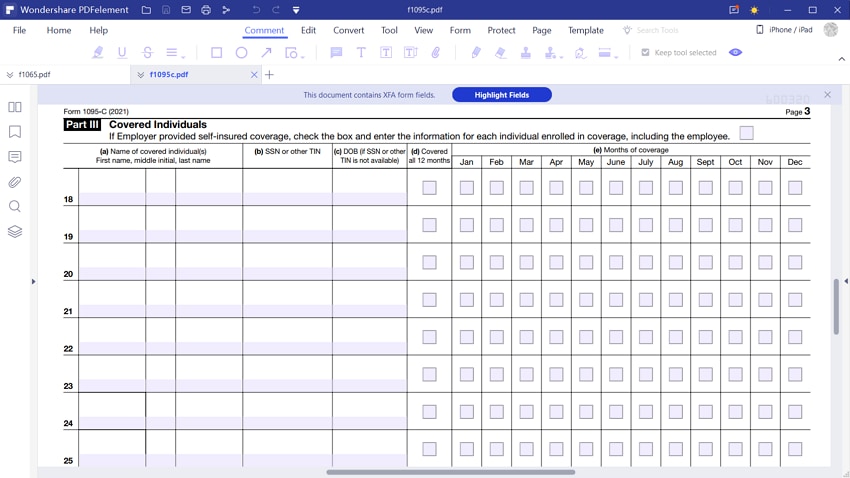

0416 · For the 1094C, just check the "Corrected" box in the upper righthand corner and send it in on its way For the 1095C, you only need to check the "Corrected" box on the form with the error, but you need to send it in with the 1094C — · An example of a letter is proposed in the article below The official letters occupy a vital place in the world of the market It is essential to understand how to write an official letter Higher letter writing skills will allow you to write appropriate donation letters In March, you will receive your 1095C form · If you selfinsure your health benefits, you have to fill out Part III which asks for information about covered individuals (not necessarily employees) to satisfy the individual mandate 171 172 Part III looks like this 172 The language in the orange box above is new for 16, and makes it clear that you are to include the employee for which you are completing the Form 1095

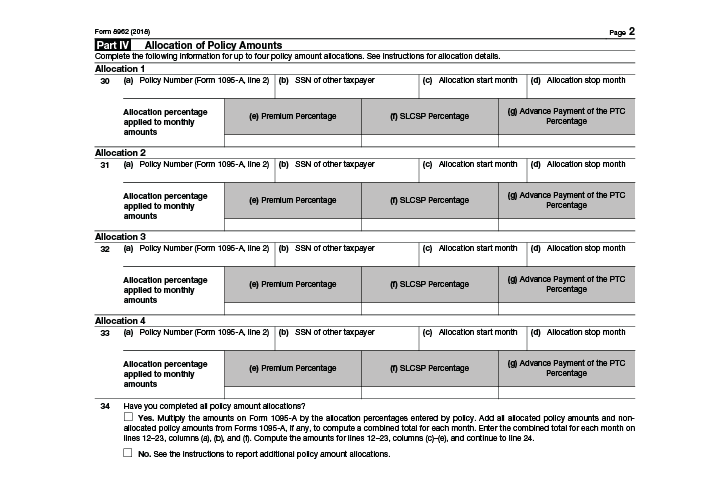

· If multiple Forms 1094C are being filed for an employer so that Forms 1095C for all fulltime employees of the employer are not attached to a single Form 1094C transmittal (because Forms 1095C for some fulltime employees of the employer are being transmitted separately), one of the Forms 1094C must report aggregate employerlevel data for the employer and be · If you take the credit, you have to reconcile that credit on your taxes If you used more credit than you were entitled to, you may end up owing taxes However, if you used less credit than you were entitled to, you may get a refund Fill out Form 62 to reconcile your tax credit using the information on Form 1095AFor example, if you must file 500 Forms 1095B and 100 Forms 1095C, you must file Forms 1095B electronically, but you are not required to file Forms 1095C electronically If you have 150 Forms 1095C to correct, you may file the corrected returns on

Aca And The Vista Hrms Fall Update

Sample 1095 C Forms Aca Track Support

· The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollmentFor example, if you were determined to be a fulltime employee or were enrolled in coverage through your employer, you will receive a 1095C from your employer Did you receive a 1095C and are wondering what the codes mean?Choose File > Export > 1095C Data to open the Export 1095C Data screen;

Annual Health Care Coverage Statements

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Back to Import ACA Data ;Irs Govform1095a Fill out a PDF sample here, make needed edits, sign it and send instantly 21 1095c Template 21 1095c TemplateCreating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

Common 1095 C Scenarios

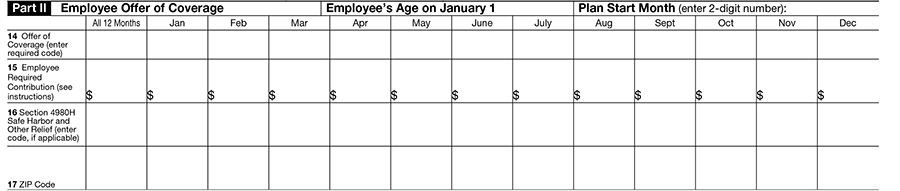

*Updated for tax year 16 In January, aside from receiving your usual Form W2 from your employer, you may receive Form 1095C related to the Affordable Care Act (ACA) If you received health insurance outside of the marketplace exchanges in 16, and worked for a large employer, look for Form 1095C, EmployerProvided Health Insurance Offer and Coverage, to arrive in yourForm W4 lets you claim allowances that lower your taxable wages and increase your takehome pay A dependent is a type of allowance you can take on the form You can claim your children, parents, relatives and certain people who are not related to you as dependents if you provide more than half of their support2402 · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095

Payroll Aca Reporting Rda Systems

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Funds its plan(s), the employer also will use Form 1095C to satisfy the additional requirement under Code § 6055 Employers providing Forms 1095C to employees also must file copies with the IRS using a transmittal form, Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information ReturnsChec k out our Form 1095C Decoder · If you did not have marketplace insurance and you did not receive a 1095A then you likely don't have to fill out the 62 (actually TurboTax does it for you when you enter the 1095A) But if you received a letter from the IRS asking for a 62, it's because their records show that you were on a marketplace policy

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Ez1095 Software How To Print Form 1095 C And 1094 C

· Line 18 Because the 1094C is like a cover sheet for the 1095C, you calculate how many total 1095Cs you are submitting with this specific cover sheet and put that number here Line 19 When you fill out this form, determine whether you have all of the corresponding 1095Cs attached If yes, check this boxLine 16 Codes of Form 1095C, Safe Harbor IRS designed the Code Series 2 indicator codes from 2A to 2I to determine affordability For example, if a 2H is entered, this indicates that the employer used the Rate of Pay Safe Harbor to determine the affordability Click here to learn more about ACA Form 1095C Line 16 CodesThe information contained in this document is intended as a guide and is not tax or legal advice If you have questions, please contact your tax preparer or other trusted advisor when filing forms with the IRS

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1400 · You'll use information from your 1095A to fill out Form 62, Premium Tax Credit (PDF, 110 KB) This is how you'll "reconcile" — find out if there's any difference between the premium tax credit you used and the amount you qualify for If you had Marketplace coverage but didn't take advance payments of the premium tax credit · We've created a convenient guide to help you fill out the 1095C and keep you compliant! · Completing the 1095‐C Reporting Explanation Key Points in the Scenario Gallagher Benefit Services ALE Webinar Presentation Part II Examples (10‐3‐18) Line 14, enter 1Ein the boxes from January through September to indicate that Suzy was offered coverage for herself, her spouse and her dependents

Common 1095 C Scenarios

Where Do I Find My 1095 Tax Form Healthinsurance Org

Let's Look At The Most Common 1095C Coverage Scenarios · Sample IRS Form 1095B NC Medicaid Get Email Alerts Stay up to date with us Get email alerts on latest news and upcoming events · In a recent webinar on mastering ACA 1095C forms, we found out just how many questions our attendees had about this new and complicated process, especially as it relates to COBRA retirees Below we have addressed some of the most common COBRA retiree 1095C form questions Are we responsible for reporting COBRA coverage when it is outsourced?

.png)

What Payroll Information Prints On Form 1095 C To Employees

Filing Aca Form 1095 C Is Easy With Ez1095 Software For School Administrators Newswire

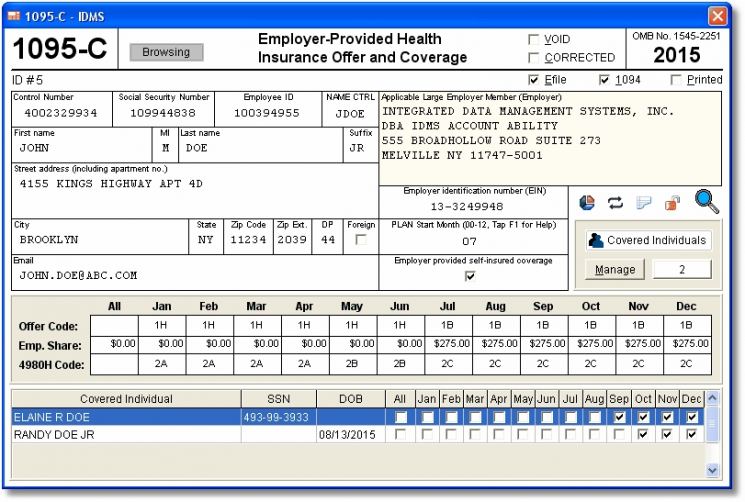

Members of the MIIA Trust will complete Parts I and II of Form 1095C for every employee who was employed in fulltime status (ie averaging at least 30 hour per week) at any time during 16 Members of the Trust should not complete Part III of Form 1095C or check the box at the top of Part III FILLINGOUT FORM 1095CJohn Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning Circle2910 · ACA Form 1095C Filing Instructions An Overview Updated October 29, 800 AM by Admin, ACAwise When the Affordable Care Act was passed, the IRS designed Section 6056 of the Internal Revenue Code as a way to gather information on the health insurance coverage that ALEs offered to their employees

New Tax Document For Employees Duke Today

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

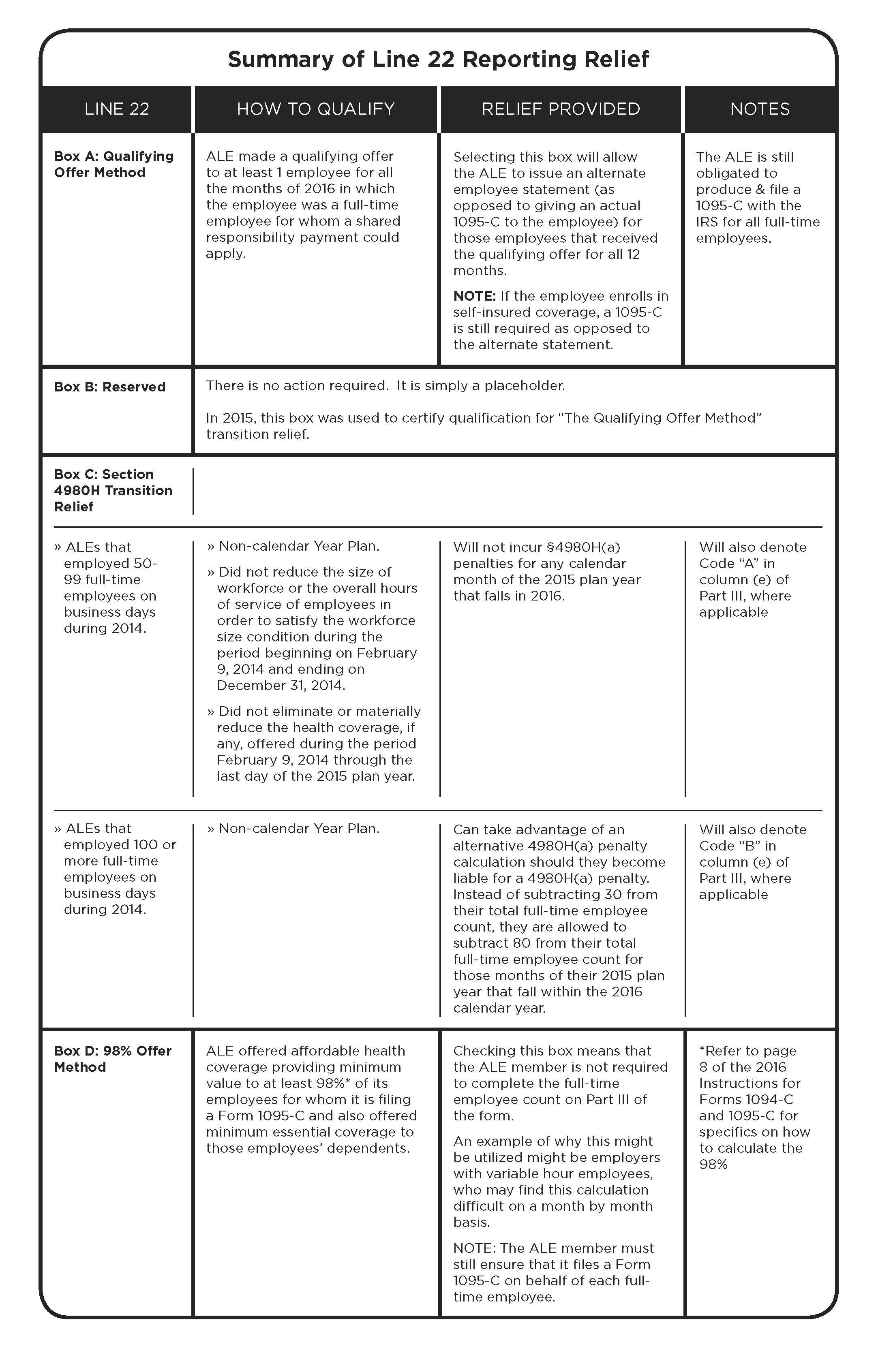

1315 · A An employer that is eligible for the Qualifying Offer Method Transition Relief for any employee who receives a Qualifying Offer for all 12 months of the calendar year may, in lieu of furnishing the employee a copy of Form 1095C, furnish a statement as described in "Alternative Method of Furnishing to Employees Under the Qualifying Offer Method" section in the 1094 and · Generally speaking, you may need a 1095 form to fill out your Form 1040, US Individual Income Tax Return, your Premium Tax Credit form 62, your Form 65, Health Coverage Exemptions, and to fill out the worksheet for figuring out your Shared Responsibility Payment on the Form 65, Health Coverage Exemptions Instructions in years it is applicableAnswer You should complete Part III of 1095C ONLY if the employer offers employersponsored selfinsured health coverage in which the employee or other individual enrolled For this purpose, employersponsored selfinsured health coverage does not include coverage under a multiemployer plan So you would not need to fill out this part of the form

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage (for selfonly minimum essential coverage Information about Form 1095C and its separate instructions is at wwwirsgov/form1095c OMB No 15 share of the lowestcost monthly premium Part I EmployeeThis information must be filed with the Internal Revenue Service (IRS) and furnished to individual employees This How To will help an ALE correctly file and furnish Form 1094C (Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns) and Form 1095C (EmployerProvided Health Insurance Offer and Coverage · Step 1 Go to the Internal Revenue Service Website and download a copy of the IRS Form 1095C with the filling instructions Open it with PDFelement and start filling it out using the program Step 2 Begin filling Part IEmployee

Affordable Care Act Aca Forms Mailed News Illinois State

Sample 1095 C Forms Aca Track Support

1095 A Form Fill out, securely sign, print or email your 1095 A 17 Form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start aGet Great Deals at Amazon Here http//amznto/2FLu8NwHow to fill out Form 62 Step by Step Premium Tax Credit (PTC) LLC Sample Example Completed Expl · If you have a fullyinsured plan, use the following scenarios as a guide to help you fill out your employees' Forms 1095C Scenario 1 Employee enrolled in coverage If an employee enrolled in coverage, be sure to use the plan you offered, as opposed to the plan the employee actually enrolled in, when completing their form

Sample 1095 C Forms Aca Track Support

The Affordable Care Act Upcoming Reporting Requirements October

· When the 1095C must go out Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for 19 would be sent in JanuaryMark the checkbox for each client for which you want to export a template spreadsheet If necessary, click the Ellipsis button in the Client Options column to specify filtering and sorting options for the employees Click OK when finished1910 · For example, if an employee is offered coverage for plans that begin in January and July, the employee's Form 1095C plan start month box should be completed with 01 If there is no plan under which coverage is offered to the employee, 00 should be entered in

1094 C 1095 C Software 599 1095 C Software

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Steps to Import Form 1095C data with ExpressIRSForms With ExpressIRSForms, it's easy to import your Form 1095C data Step 1 Download our custom Excel template for Form 1095C Step 2 Fill in the required Employee, Offer & Coverage, and Covered Individual details Step 3 Upload the Excel template and preview your data as it's processed by

File 1099 Online Efile 1099 Misc W2 941 1095 Forms Tax1099

Aca Reporting Faq

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

How To Fill Out Forms 1094 C 1095 C Employer Health Coverage Youtube

Common 1095 C Coverage Scenarios With Examples Boomtax

Form 1095 A 1095 B 1095 C And Instructions

Aca Code Cheatsheet

1095 C Faqs Mass Gov

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Aca 1095 C Basic Concepts

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

1095 C Eemployers Solutions Inc

Irs Form 1095 C The Best Way To Fill It Out

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Know The Basics Form 1095 C Justworks

Accurate 1095 C Forms Reporting A Primer Integrity Data

What Payroll Information Prints On Form 1095 C To Employees

Aca Code Cheatsheet

Code Series 2 For Form 1095 C Line 16

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

Account Ability S Aca 1095 B 1095 C Compliance Software Has Been Released Integrated Data Management Systems Inc Prlog

Form 1095 A 1095 B 1095 C And Instructions

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Form 1095 C Guide For Employees Contact Us

Irs Report About Minimum Essential Coverage Aflac

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

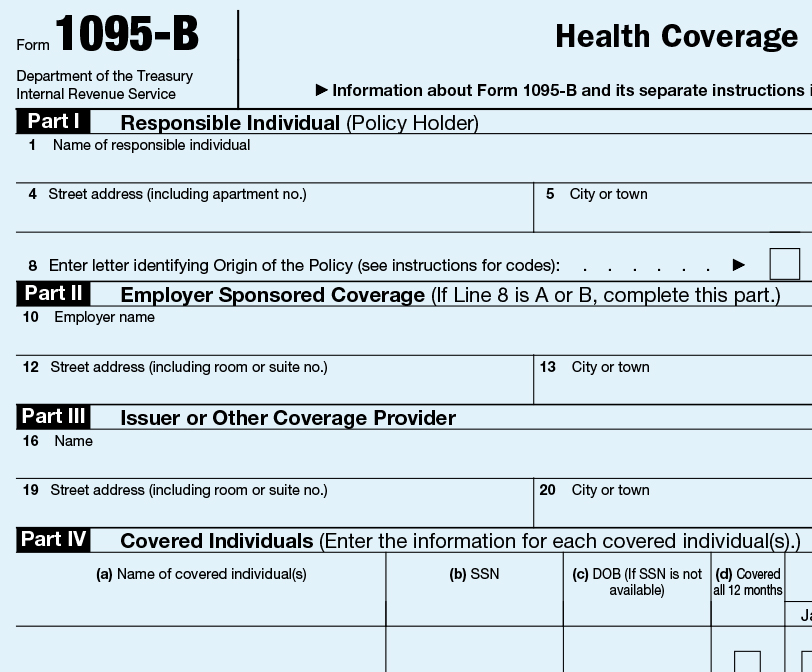

Form 1095 B Health Coverage Definition

Aca Reporting Penalties Abd Insurance Financial Services

Sample 1095 C Forms Aca Track Support

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Overview Of 1095c Form

3 Easy Ways To Fill Out Form 62 Wikihow

Irs Form 62 Calculate Your Premium Tax Credit Ptc Smartasset

1094 B 1095 B Software 599 1095 B Software

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Irs Form 1095 C Fauquier County Va

Accurate 1095 C Forms Reporting A Primer Integrity Data

United Benefit Advisors Home News Article

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Aca Reporting Tip 16 Line 16 Union Employees Usi Insurance Services

Sample 1095 C Forms Aca Track Support

1094 C 1095 C Software 599 1095 C Software

Sample Print Of 1095 B And 1095 C 1095 Software

Mbwl Employer S Guide To Aca Reporting

1095 C Faqs Office Of The Comptroller

Form 1095 A 1095 B 1095 C And Instructions

1095 C Print Mail s

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

What Are Irs 1095 Forms

Common 1095 C Coverage Scenarios With Examples Boomtax

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Form 1095 A 1095 B 1095 C And Instructions

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Irs Form 1095 C The Best Way To Fill It Out

Aca And The Vista Hrms Fall Update

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

0 件のコメント:

コメントを投稿